There hasn’t been much Permian-centric M&A follow-through from last spring’s buy-out of Anadarko Petroleum by Occidental, (NYSE: OXY). At the time, the sages and pundits were widely predicting an M&A frenzy to carve up the turf. It didn’t happen. The likely reason being that there was so much fall-out from that deal for OXY, that “fear of glowing in the dark,” probably calmed the bloodlust of other potential raiders. For a while.

There’s nothing so powerful as an idea whose time has come however, and the current wave of Permian bankruptcies and asset write-downs provided an inflection point for the M&A sharks to begin circling their quarry.

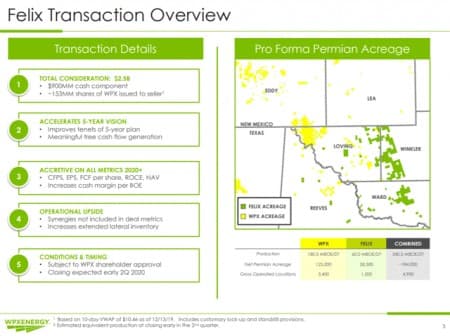

In December of last year, Felix Energy (Privately held) said, “yes,” to WPX Energy, (NYSE: WPX) with a second quarter 2020 “wedding date.” The funny thing was, the market approved, with WPX shares getting a nice boost just before Christmas. Stock analysts at Piper Jaffray simply gushed:

“Overall, the deal “looks favorable for WPX at first blush”, Piper Jaffray analysts said, as the company is increasing Delaware scale at an attractive valuation and gradually pivoting away from the Williston basin, which was poised to exhaust inventory in the coming years at the current pace of activity.”

Wow…after all the “Sturm und Drang,” from the market about the OXY deal a half year before, here was a sizable deal that wasn’t getting pilloried. Coincidence? My “spider-sense” began to tingle and I decided to take a closer look at this deal and see if I could ferret out what made this one work in the eyes of the market.

With that information, perhaps we can see "around the corner" and make a call as to which Permian player might be next. That's where the fun and the money are in this business.

Strategic rationale

"Strategic Rationale," that term suggests that the company's management is looking beyond the next quarter, and helps to give me a “warm fuzzy,” when I see it. Senior management's real job, the reason they make all that money, is to position the company for growth in five to ten years. They have middle managers to run the company day-to-day. The big guys have to read the tea leaves and chart course through the wilderness. Here's what Rick Muncrief, WPX's CEO, had to say about this transaction:

"Delivering on our plan ahead of schedule in a highly de-risked, leverage-neutral manner is consistent with our opportunistic approach.

On a pro forma basis, WPX expects to generate significant free cash flow in 2020 at $50 oil. Following the acquisition, cash flow per share, earnings per share, free cash flow per share, return on capital employed, and cash margins are all expected to increase. Related: Peak Shale Will Send Oil Prices Sky High

WPX also expects to continue its opportunistic share buybacks, to implement the previously mentioned dividend program, and to reduce its leverage to 1.0x by year-end 2021.

WPX based all of its transaction economics on $50 oil, with no assumptions for improvements in development costs or operating efficiencies. However, WPX believes significant upside exists by capturing synergies associated with scale."

I've highlighted what to me is the most relevant comment from the quote above. "Scale", if you've read a few of my Permian oriented articles in OilPrice, over the past year or so, you've heard me talk about this notion. It is one of the five tenets I've espoused about successful operators in North American shale plays going forward. Here they are again, if somehow you missed them, or have slept a time or two since reading them last.

Rock quality Scale Logistics Low costs of production TechnologyScale is right up there at the top as it should be. Scale helps to deliver low costs of production; the bigger the resource base, the more cost is distributed over each barrel.

Felix's Assets

Here's where scale begins to take on meaning. 1,500 drilling locations at 50 or so a year translates to a 30-year opportunity horizon. WPX stands to gain approximately 1,500 gross drillable locations (at predominately 2-mile lateral lengths) that compete with the returns from its existing position in the core Stateline area of the Delaware Basin. Not too shabby!

Felix has 58,500 net acres in an over-pressured, oily portion of the basin with six productive benches. Approximately 25 additional wells are required to hold nearly all Wolfcamp and Third Bone Springs rights, with approximately half of those wells expected to be drilled in 2020.

Felix’s recent multi-well pads with at least 12 months of cumulative gross production are averaging approximately 240,000 barrels of oil per well, with pad averages ranging from 213,000 to 260,000 barrels of oil per well. Felix’s average lateral length is 9,200 feet per well.

Felix's acreage has been delivering top tier performing wells, and outperforming many larger companies. WPX is getting those 58.5K choice acres for $42K per, for its $2.5 bn. For reference, OXY's bid for APA was in the $80K per acre range. I'm not making a judgement here on the OXY transaction based on that disparity, the market has been doing that for me just fine. My point is that the WPX/Felix transaction doesn't look like a hog slaughter using the OXY metrics.

It also increases the WPX acreage base by over 50% and roughly the same for their identified drilling locations.

Felix was a willing partner for the right buyer

Felix Energy had expressed interest in selling in late 2018. At that time, valuations were much higher for shale acreage in the 70-80K per acre range. Felix probably hoped to get snapped up in that era. A Reuters article commented:

"Earlier this year, RSP Permian and Energex Corp. (NYSE:EGN) were bought by Concho Resources Inc (NYSE:CXO) for $8 billion and Diamondback Energy Inc. (NYSE:FANG) for $9.2 billion, respectively. Concho paid more than $70,000 an acre in its deal."

The turmoil was introduced into the market by OPEC and the fears of global energy demand falling off, probably led to a lack of focus toward this goal, and adding a year or so to the negotiations. By the time they got serious about it, the market had fallen off quite a bit, and $3.5 billion turned into about $2.5 billion. Good for WPX shareholders and toughies for the folks at Felix. Nonetheless, WPX avoided an acrimonious fight with a management that really doesn't want to be bought. Or a bidding war. A win, win if ever there was one.

WPX Financials as of Q3 2019

WPX has been growing production QoQ. In Q3 this year, they reported 173,400 boe (barrels of oil equivalent) per day, representing a 40.1% over the 123,800 boe per day in the same quarter in 2018. It is a reasonable expectation for them to exit the year in a range of 162,000 boe-167,000 boe per day.

So far so good, the company had a few things they needed to work on as of the Q3 report. Those primarily revolved around fixable stuff like lease and facility expense grew from $5.92 per boe to $6.02 per boe YoY. More or less the same for gathering, processing, and transportation costs. These jumped from $2.29 per boe to $3.10 per boe. Related: Could This Be The Decade Of Green Hydrogen?

Finally, overall leverage rose from $2.07 billion to $2.22 billion. Something the company addressed in the call and committed to seeing net leverage drop to around 1 times EBITDA. On an annual basis, the firm’s third-quarter EBITDA of $352 million represents an EBIDTA of $1.41 billion, yielding a net leverage ratio of 1.57. So this seems doable, given their fairly modest assumptions about the oil price.

The financial outtakes above indicate that WPX is a pretty well-managed company with a clear vision of where it needs to go to stay relevant in a changing marketplace. Certainly their YoY production growth of 15% while in an era of capex restraint speaks well of management's ability to execute.

A good basis to take over another company and make it better!

So who's next?

The deals are likely going to get better for those with some money in their pockets. Many smaller companies will be closer to the edge, and selling at a discount or facing too much debt, restructuring and possibly bankruptcy. They aren't going to be in much of a position to bargain when players with fat wallets come calling.

Our challenge then is to figure out who's who. Who's got the money, and who might be willing to talk turkey.

Exxon Mobil, (NYSE: XOM) Chevron (NYSE:CVX) and Shell (NYSE:RDS.A) (RDS.B) and to a lesser extent BP (NYSE: BP) and French Total SA (NYSE:TOT) all have plenty of cash to go shopping for a good company with strong assets.

It’s not only the super majors that will be in the hunt, just down the size-scale a bit there are also some good sized companies with surplus cash include: ConocoPhillips (NYSE: COP), EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), Noble Energy (NASDAQ:NBL), Devon Energy (NYSE:DVN) and Diamondback Energy, (NYSE:FANG). The response to the December WPX deal will have made the radar of all these outfits.

It could be a case of big fish looking at smaller fish with a good asset base. Say, for example, while Exxon might look at swallowing a semi-big player like EOG Resources, EOG could possibly looking to drill on Wall Street. It won't take a lot in our estimation to spark an M&A chain reaction in the Permian.

Your takeaway

To sum it all up. If I had to pick one thing that would be useful to measure other candidates by, it would be their prime acreage position in the Permian. Rock quality is key to survival. Next would be their willingness to do a deal. The days of $70-80K per acre are probably in the past, unless one of my other theories about assets here in North America being underpriced with respect to equivalent assets almost anyplace else. With the exception perhaps of Ghawar in Saudi Arabia, there are no equivalent onshore assets to the Permian when it comes to the resource base and developed infrastructure. Someday, I think the market will recognize that fact. Finally, a prime target would be a company that is doing well in today's market but could be made better with the synergies of a merger.

Richard Muncrief may have tipped his hand a bit in regard to an acquisition in the Q3 call, well before the Felix deal was announced. This was in answer to a well-placed analyst's teaser question.

"I do think that there are companies that -- that are -- both on a public side and on private side they need to really strongly consider rolling themselves into a stronger entity. But that's going to be their call and how that all plays out. But as far as us, we do think number one that consolidation needs to happen in our sector; number two, it is a tricky to make sure that is a truly accretive and not just something to build scale or and build inventory. And number three, for us, it really needs to tie into our five year plan. And if we can look ourselves in the eye and say, this transaction supports that, I think, that's something

It won’t surprise me if there are other oil execs pondering the same set of circumstances, and hoping to “get a ring on their finger.”

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

Comments